Cryptocurrency in the Institutional Space

Kyle Boston, Vice President

First Coast Financial Group

The crypto-craze has reached far and wide at this point in time. With the SEC on the brink of a decision regarding the VanEck Crypto ETF (and others), it is becoming a very real possibility that institutional investors will now have access to the crypto space like retail investors have. For this reason, I have decided to take a deep dive into the concept.

For those that are not very familiar with Bitcoin and other Cryptocurrencies, I highly recommend reading (at least the beginning portion) of Citi’s paper (Kaul, et al., 2021). They do an excellent job breaking down the concepts.

https://www.citivelocity.com/citigps/bitcoin/

Ultimately, our firm has had a very pessimistic view on crypto as an investment up to this point due to the fact that its value lies primarily in its scarcity and that it will compete with traditional fiat currencies as a payment method/currency.

After a good deal of research, I have found the following opportunities or “bright spots” in the space:

- Potential for Bitcoin, in particular, to be held as a collectible asset class

- Brand-name in the space

- Momentum has been established

- As Citi’s paper notes, it can be viewed as the “North Star” for crypto

- “Digital Gold”

- Low correlation to traditional “risk-off” assets

- Potential for both Bitcoin and Alt-coins to create a very high-speed, always-open payment structure that is borderless.

- This would shake up our current financial system and payment methods, but wouldn’t be introducing concepts that are entirely unfamiliar

- Companies like Paypal, Square, and Venmo are already incorporating some key aspects of crypto and cryptocurrency exchange

- This would shake up our current financial system and payment methods, but wouldn’t be introducing concepts that are entirely unfamiliar

Either opportunity/scenario listed above would be vulnerable to a multitude of different factors that are incredibly important to consider (especially from an institutional perspective).

Bitcoin’s position as a collectible or a “digital gold” is entirely reliant on the concept of scarcity that is baked into its creation and production. Only 21 million Bitcoin can be produced. Here are some of the following risks associated with this being a valid asset class used in portfolio design and construction:

- Scarcity

- With the continued development and implementation of alt-coins, Bitcoin no longer is the dominant force in the space. Coins like Ethereum, among others, are making a push for market cap. Per Citi’s paper, Bitcoin now only commands roughly 62% of market capitalization in the space.

- While there is only 21 million Bitcoin available, bitcoin itself is scarce, but with the widespread development and influx of capital to these alt-coins, crypto itself is becoming less and less scarce.

- My question here lies in whether or not Bitcoin will survive truly as a unique collectible or if these other currencies dilute its value.

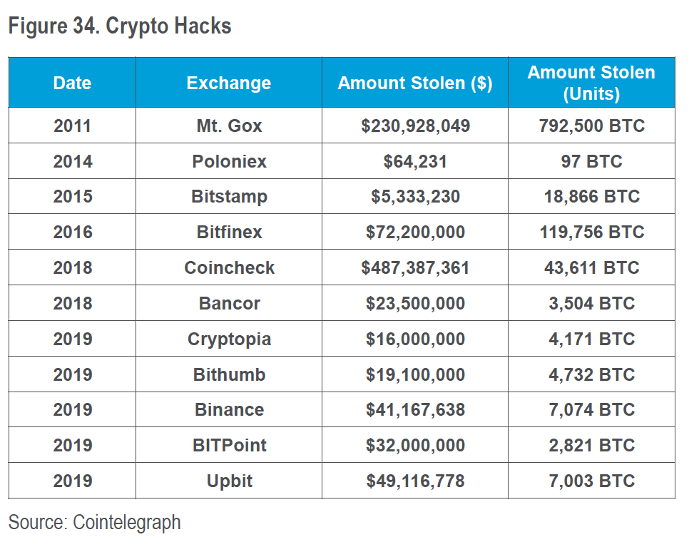

- Security

- We can draw the conclusion that one of the primary reasons that the SEC hasn’t approved the cryptocurrency space for institutional trade is based on the fact that these cryptocurrencies, exchanges, and personal wallets are not secured and insured the way traditional currencies and commodities are.

- There have been a number of notable hacks and cyber-crime in the space; especially over the past couple of years.

(Kaul, et al., 2021)

- Currently, USD deposits and savings at a fair share of financial institutions are insured by FDIC or similar insurance. There is a much more limited selection of insurance in the crypto space and it is very costly.

- Securing physical gold assets has been a business for hundreds of years and is far more established.

- The growth and effectiveness of the security of crypto assets is something that will have to be closely monitored both now and moving forward.

- Sustainability

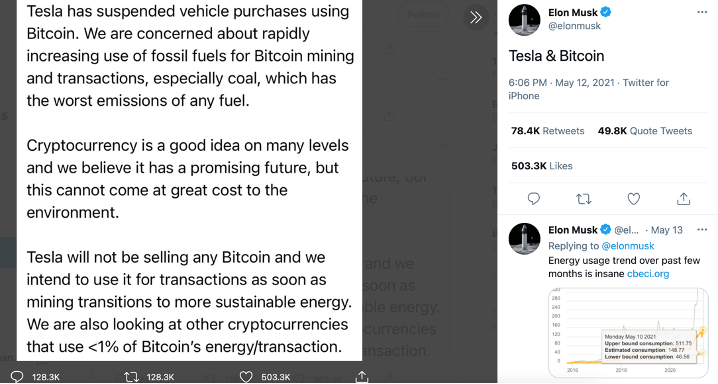

- As the world is moving forward with ESG (environmental, social, governance [standards]) investing in both the retail and institutional spaces, the sustainability of cryptocurrencies has been brought into question(Chipolina, 2021).

- Per Citi’s paper, “….another index, compiled by the Cambridge Center for Alternative Finance, estimates a higher figure of around 108.4 terawatt-hours.” (in terms of bitcoin’s annual energy consumption).

- In recent news, Elon Musk stopped accepting payments in Bitcoin (a particularly stunning reversal) due to the fact that they may have overlooked Bitcoin’s environmental impact. Here is the exact tweet:

- As the world is moving forward with ESG (environmental, social, governance [standards]) investing in both the retail and institutional spaces, the sustainability of cryptocurrencies has been brought into question(Chipolina, 2021).

(Musk, 2021)

In terms of whether or not cryptocurrencies will end up becoming the predominant form of currency and payment method, I believe that a lot of that lies with how these current issues are dealt with. Another area of concern there is whether or not sovereign governments will be willing to relinquish control of their central currency. A lot of the rhetoric in both Bitcoin and these alt-currencies is that they are working to create a currency that is free from any government control or regulation. That is already ruffling feathers in countries like China.

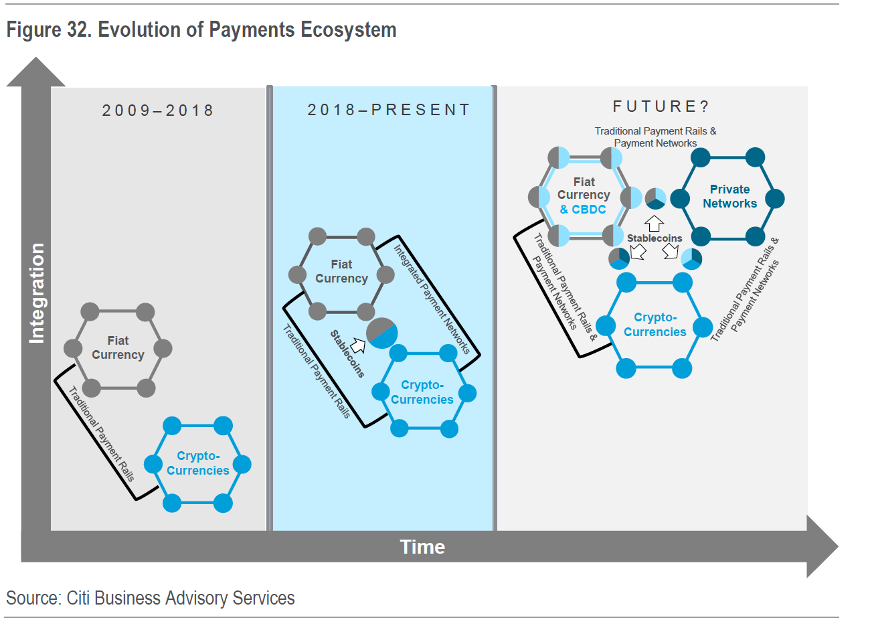

Another question is how exactly will the final form of cryptocurrency transactions look? Per Citi’s paper, it looks like they are projecting it will be something like this:

(Kaul, et al., 2021)

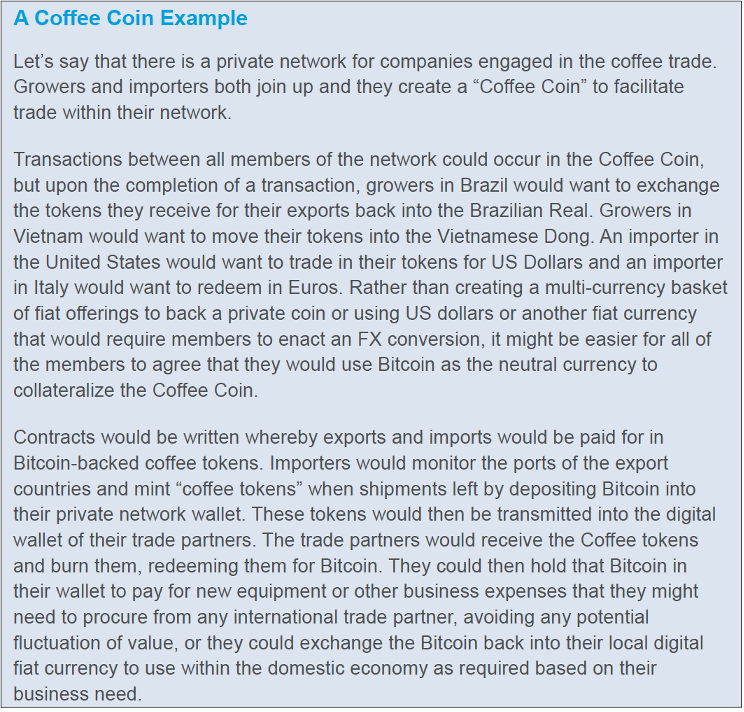

To put some words with the picture, here is their example:

Figure 1: (Kaul, et al., 2021)

Is using private payment networks in accordance with a handful of digital currencies/stablecoins plus traditional currencies logical/sustainable? If we look at the difficulties that average small business owners here in the US face in tax planning and filing, this may end up adding another element of confusion. This brings to light the issue of whether or not/how consumers will interact with the currency moving forward regardless of the legislation that countries will impose.

Also, could we end up seeing central banks implementing their own CBDC (Central Bank Digital Currencies) built upon the same concepts and technologies? Sure. It is already happening in Europe and the groundwork has been laid in the US (Keely, 2021).

In sum, the opportunity in the cryptocurrency space is large. The market capitalization of Bitcoin and the alt-coins reflects this. The big question is are investors betting on the fact that Bitcoin/cryptocurrencies will continue to be used as a collectible asset class and the dominant currency/payment system? Or is that yet to come? Either way, the risk is seemingly unlimited in this space and it is extremely speculative at this point in time. If investment directly into cryptocurrencies becomes available in the institutional space, it is very likely that our firm may view it as a suitable investment for Moderate – Aggressive investors. Namely as a small part of portfolio construction as an asset class with low correlation to traditional currencies/commodities/other risk-off assets or even a growth opportunity in some instances. In the meantime, we are looking at investments that are more focused on the underlying technology that cryptocurrency is built on instead of the finished product itself.

Investment advisory services offered through Brookstone Capital Management, LLC (BCM), a Registered Investment Advisor. BCM and First Coast Financial Group, Inc. are independent of each other. Insurance products and services are not offered through BCM but are offered and sold through individually licensed and appointed agents.

Works Cited

Chipolina, S. (2021, May 18). Ark Invest Defends Bitcoin’s Environmental Impact Following Elon Musk Tweets. Retrieved from Decrpyt: https://decrypt.co/71228/71ark-invest-defends-bitcoins-environmental-impact-following-elon-musk-tweets228?&utm_medium=referral&utm_campaign=feed&utm_source=coinbase

Kaul, S., Webley, R., Klein, J., Maini, S., Malekan, O., & Niculcea, I. (2021, March). Citi. Retrieved from Citi Velocity: www.citivelocity.com/citigps/bitcoin

Keely, A. (2021, May 4). Stablecoins. Retrieved from The Block Crypto: https://www.theblockcrypto.com/linked/103693/digital-dollar-project-cbdc-pilot-giancarlo

Musk, E. (2021). Twitter. Retrieved from Twitter: 1. https://twitter.com/elonmusk/status/1392602041025843203/photo/1

Special thanks to:

Bill Aldrich, Mark DiOrio, CFA, Alex Bobin, CFA

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.